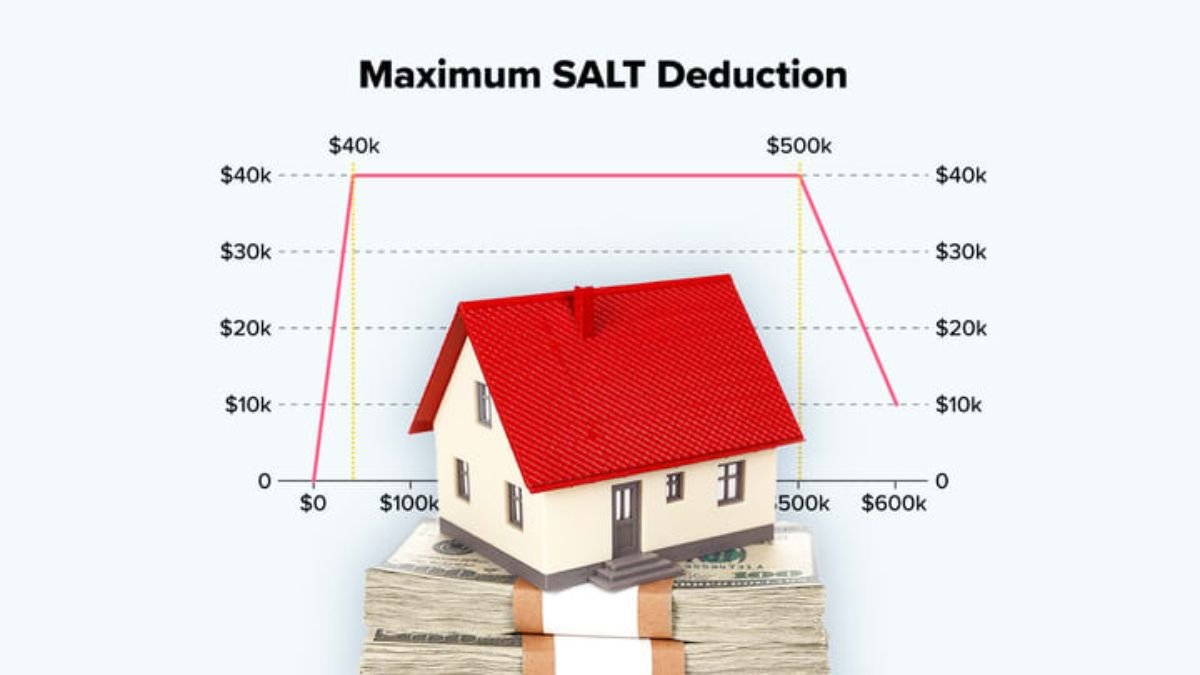

Another significant overhaul of the US tax system has been realized. The State and Local Tax Deduction (SALT) cap is now increased to 40,000 in the year 2025. This shift, as declared by the former President Donald Trump, has generated a new economic debate in the country. It is the same cap that was already capped in the Tax Cuts and Jobs Act (TCJA) of 2017. It is the first rise in almost eight years and is likely to relieve millions of American taxpayers.

This will be more relevant to states where the income taxes as well as property taxes are high. But here is the big question — will this relief increase even more the federal revenue deficit? Now, we are going to discuss this change step by step and the reasons why it was changed and who is going to be the most benefited.

History of the SALT Deduction – A History Starting in 1913

SALT exemption was introduced in the year 1913 when the U.S. government introduced this provision in the tax system to avoid taxation twice. In this provision, state and local taxes — income tax, sales tax, and property tax — were deductible by the taxpayers to federal taxes.

This exemption was unlimited in that over the decades you could deduct the amount of state or local taxes you paid in federal taxes. In 2017, though, it was restricted by the Tax Cuts and Jobs Act (TCJA). The new amount was pegged at 10,000 per household so that the government could cover the cost of other tax deductions.

The impact of this decision was especially on high-income and high-property tax states — New York, California, New Jersey, Connecticut, and Massachusetts. In 2025, however, the new $40,000 limit will ensure that the new limit can breathe relief to millions of people in these states.

Who Will Benefit the Most?

According to the opinion of tax experts, high-income families will be the greatest benefactors. A report by the Tax Policy Center (2021) suggested that if the SALT cap were fully lifted, about half of the benefits would be enjoyed by households with incomes of over $1 million annually.

Nonetheless, middle- and upper-middle-class families would also get better benefits, particularly in those states where the prices of homes and tax rates are already high.

The average SALT deduction in New York, New Jersey, California, Connecticut, and Massachusetts in 2022, based on IRS data, was between $9,600 and $10,000. This implies that nearly all taxpayers had approached the former limit. As of now that the limit of 40,000 has been put into effect, they will be able to dedicate a greater percentage of the total tax.

Status of High-Tax States

A table on the status of some of the major states is given below:

| State | Average SALT Deduction (2022) | Probability of Hitting Cap |

|---|---|---|

| New York | $10,000+ | Very High |

| New Jersey | $9,800+ | High |

| Connecticut | $9,700+ | High |

| California | $9,900+ | High |

| Massachusetts | $9,600+ | High |

These statistics clearly show that the majority of the citizens of such states were already under the influence of the 2017 cap. Thus, the increase of the SALT limit has long been the goal of the legislators of these states.

Rising Property Tax Burden

The increase of property taxes has been immense during the last several years. The National Association of Realtors reported that property tax bills rose by 23 percent from 2019–2023.

As an illustration, the property taxes in Westchester County, New York are reputed to be among the highest in the United States. Homeowners are very relieved to see the expansion of the SALT deduction in such a scenario.

Revenues on these taxes benefit the state and local governments. According to the report prepared by the Citizens Budget Commission in 2022, the state and local governments in New York had a spending of $15,368 per capita but did not collect taxes of $12,751 per capita. This demonstrates how strained state budgets have become — and why the SALT exemption has turned out to be so necessary.

Impact on Federal Revenue

The next topic of this change that we want to talk about is its effect on the federal deficit, which is the largest concern of this change.

An increase in government tax exemption implies that government revenue reduces directly. This is why it was limited in 2017.

Any increase to 40,000 in the year 2025 will imply a lot of loss to the government in revenue. The Joint Committee on Taxation (JCT) estimates that this would cause a deficit of $142 billion during 10 years. The Tax Foundation estimates this cost to be even bigger — about $320 billion in case the cap is not removed until 2025.

10-Year Projected Deficit

- Joint Committee on Taxation: $142 billion

- Tax Foundation: $320 billion

These statistics imply that this policy, although offering relief, may also add more to the federal debt that has already hit $1.628 trillion.

Economic and Political Implications

This is not just a shift in taxes but also a serious political shift. In high-tax states, this choice might be popular since people have always believed that the SALT cap was not fair.

Conversely, there exists a sentiment among the people of low-tax states that such a policy is biased towards the rich who already have an excellent advantage in terms of tax benefits.

Economically, this will have a more positive impact by increasing consumer spending in the medium run since taxpayers would now have more to save or spend. Nevertheless, in the long run, the increasing deficit may affect inflation and interest rates.

Is This to Be a Permanent Decision?

The current announcement is only for 2025. That is why the SALT limit might go back to the level of $10,000 unless new legislation is adopted by Congress.

This limit, however, can be expanded permanently in case economic or political pressure is raised. It is the opinion of many analysts that with the continuation of this policy, it might forever change the tax structure of the US in the coming decade.

Conclusion

The rise in the maximum outlay on SALT deduction is definitely saving the lives of millions of American families. This is particularly relevant to the people who reside in high-tax states and whose property tax rates are already high.

However, conversely, the changes will result in the loss of federal revenues and the rise of the national debt as well. As such, it may be viewed as a balance between fiscal accountability and fairness in taxes.

In the final analysis, this ruling shows that American tax policy is not a simple numbers game anymore but a complicated tradeoff between social justice and economic stability.

There is a possibility that 2025 will be the year of tax relief for you if you live in a high-tax state. This leaves a thorny question to the government — is this relief sustainable, or is this a political action?

FAQs

Q1: What is the new SALT deduction limit for 2025?

A. The new SALT deduction cap has been increased to $40,000 for 2025, offering major tax relief to high-tax states.

Q2: Who benefits most from the increased SALT cap?

A. High-income households and residents in states like New York, California, and New Jersey will benefit the most.

Q3: Will the higher SALT deduction affect federal revenue?

A. Yes, experts estimate it could increase the federal deficit by $142 to $320 billion over ten years.